In Brief

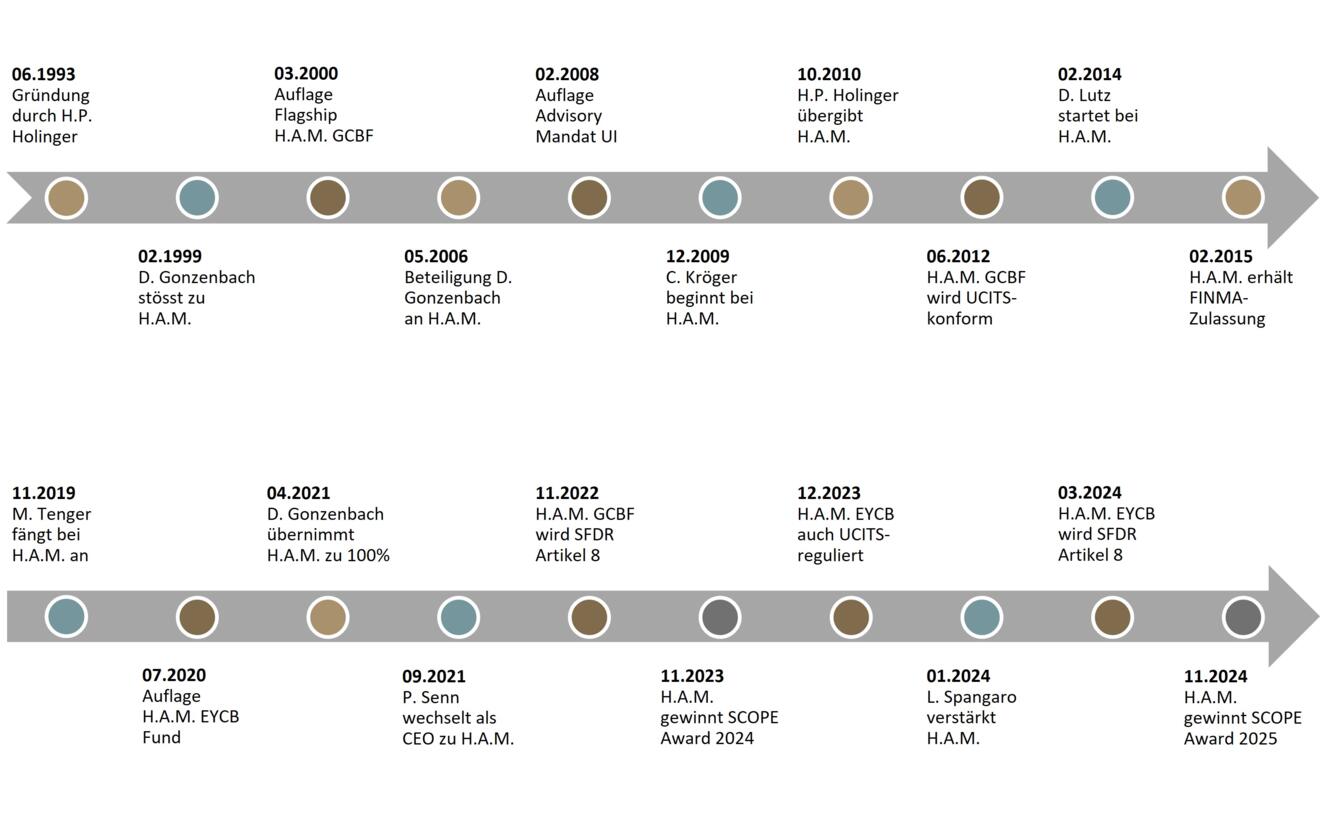

We are a Zurich-based boutique specializing in global convertible bonds. Since our founding in 1993, we have provided active asset management with the aim of generating absolute performance.

Our flagship «H.A.M. Global Convertible Bond Fund» was launched in March 2000 and reflects our commitment to continuity and outstanding performance. We invest globally, focusing on valuation and diversification. The strategy is actively managed without regard to a benchmark.

Since July 2020, we have introduced another strategy with the «H.A.M. Enhanced Yield CB Fund». We aim for optimized yield to maturity combined with selected equity sensitivity. This strategy is also actively managed without a benchmark.

As an independent company, we have been regulated by FINMA since February 2015, and our funds comply with UCITS requirements.

Your Partner for Convertible Bonds

| Specialized in Convertible Bonds | We are passionately 100% focused on convertible bonds and pool our resources to offer our investors the best possible performance. |

| Independence | As an independent investment boutique, we make decisions solely in the best interest of our clients, free from external influences or conflicts of interest. |

| Access to the Team | We grant our investors direct access to our decision-makers / portfolio managers and are always available to answer questions or provide detailed information. |

| Outstanding Expertise | Our investors benefit from highly qualified experts with long-standing and proven experience as well as direct proximity to the market and market participants. |

| Active Management | We work independently of an index with the goal of generating sustainably attractive performance for our investors. We consider all sources of income like delta, yield or valuation. |

| Performance Record | Our outstanding performance has been achieved over a long period across various market cycles and confirms our investment philosophy. |

| Transparency | Our organisation, processes, and decisions are transparent and comprehensible, while timely reporting creates a profound understanding of strategies and markets for our investors. |

| Consistency | Persistence in our actions supports a reliable and proven partnership. It also helps strengthen our market presence and ensures trust among our investors and market participants. |

| Diversified Investor Base | Our assets under management are broad-based and characterized by a long-term oriented and informed investor base. This particularly contributes to market stabilization. |

Our Awards

Our commitment to continuity and performance is confirmed by external market observers.